Facts About Rating On Appliances Revealed

Wiki Article

Get This Report on Rating On Appliances

Table of ContentsAll About Rating On AppliancesFacts About Rating On Appliances Uncovered10 Simple Techniques For Rating On AppliancesRating On Appliances for Dummies

House insurance may additionally cover medical expenses for injuries that individuals endured by getting on your home. A home owner pays an annual premium to their home owner's insurer. Typically, this is somewhere in between $300-$1,000 a year, depending on the plan. When something is harmed by a disaster that is covered under the home insurance plan, a homeowner will call their residence insurance provider to sue.House owners will normally have to pay an insurance deductible, a set amount of cash that appears of the house owner's budget before the house insurance policy business pays any cash in the direction of the claim. A residence insurance coverage deductible can be anywhere in between $100 to $2,000. Normally, the higher the deductible, the lower the annual costs expense.

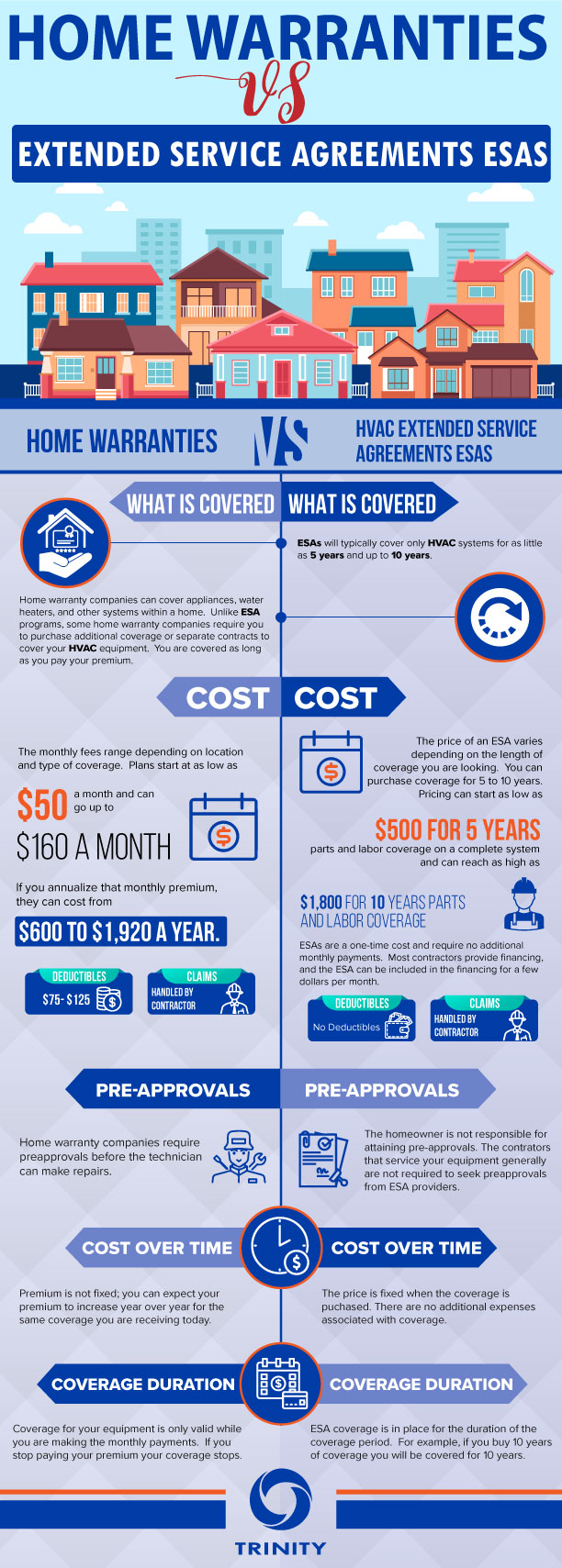

What is the Distinction Between Home Service Warranty and Residence Insurance Coverage A home service warranty contract and also a home insurance plan operate in comparable ways. Both have an annual premium as well as an insurance deductible, although a home insurance coverage costs and insurance deductible is often a lot greater than a house service warranty's. The main differences in between residence warranties and also home insurance coverage are what they cover.

An additional difference between a house guarantee and also home insurance is that home insurance coverage is usually required for house owners (if they have a home mortgage on their house) while a home guarantee strategy is not called for. A residence warranty and home insurance coverage give protection on different components of a house, and also with each other they can shield a homeowner's budget from pricey repairs when they inevitably emerge.

Rumored Buzz on Rating On Appliances

If there is damages done to the structure of your home, the owner will not need to pay the high costs to fix it if they have house insurance coverage. If the damage to the residence's framework or home owner's possessions was produced by a malfunctioning appliances or systems, a residence guarantee can help to cover the pricey repair services or replacement if the system or device has actually stopped working from normal deterioration - rating on appliances.They will certainly work with each other to supply protection on every component of your house. If you're interested in acquiring a house warranty for your house, take a look at Spots's home service warranty plans and also prices here, or demand a quote for your home right here.

The difference is that a home service warranty covers a variety of things instead than just one. There are 3 conventional sorts of residence guarantee strategies. System prepares cover your home's mechanical systems, consisting of cooling and heating, electric as well as pipes. Home appliance strategies cover major devices, like the dishwashing machine, stove and washing maker.

The Definitive Guide for Rating On Appliances

Some things, like in-ground sprinklers, swimming pools and also septic tanks, may call for an extra guarantee or could not be covered by all residence warranty companies. When comparing house guarantee firms, make certain the strategy options encompass whatever you would certainly desire covered. rating on appliances.New construction homes frequently included a service warranty from the builder.Contractor guarantees normally do not cover home appliances, though in an all new house with new appliances, manufacturers' warranties are most likely still in play. If you're obtaining a residence guarantee for a brand-new residence either brand-new building and construction or a residence that's brand-new to you protection normally starts when you close.

Simply put, if you're getting a house as well as a problem comes up during the residence evaluation or is noted in the vendor's disclosures, your residence guarantee business may not cover it. As opposed to counting exclusively on a warranty, attempt to bargain with the seller to either fix the issue or offer you a credit history to help cover the price of having it taken care of.

10 Simple Techniques For Rating On Appliances

residence insurance policy, A residence service warranty is not the like house owners insurance coverage. For one, property owners insurance policy is called for by loan providers in order to obtain a home mortgage, while a residence guarantee is entirely optional. The bigger differences are in what they cover and also exactly how they function. As pointed out above, a residence guarantee covers the repair as well as replacement of items and also systems in your house.Your homeowners insurance coverage, on the other hand, covers the unforeseen. It will not help you you can try these out change your appliances since they obtained old, but house owners insurance might aid you obtain new appliances if your existing ones are harmed in a fire or flooding. With property owners insurance coverage, you'll need to meet a deductible prior to the insurer starts spending for the cost of your insurance claim.

Just how much does a house service warranty price? Residence warranties generally cost between $300 as well as $600 annually; the expense will Get More Info certainly differ relying on the kind of strategy you have. The extra that's covered, the costlier the strategy those attachments can include up. Where you live can additionally influence the price.

, you will pay a service charge every time a tradesperson comes to your residence to examine a concern. This charge can range from concerning $60 to $125 for each service circumstances, making the solution fee an additional point to take into consideration if you're going shopping for a house warranty strategy.

Report this wiki page